Cash flow management is said to be one of the two paving stones for sustainable development. For SMEs,...

India’s 1st

Business Credit

& Info Portal

CREDITQ is India’s 1st Business Credit Management & Information Platform. It facilitates both Suppliers and Buyers to initiate a Business Transaction and get an acknowledgement for the same.

Stay Safe from Scams

![]()

Some people are making online scam in the name of Business Alert InfoTech Pvt. Ltd.

Please verify the Account Number and Account Holder’s Name before making any payment transaction.

Our Bank details are:

Business Alert Info Tech Pvt Ltd, Account Number: 7777xxxx2222, 9999xxxx2222, 9724xxxx0726

Note: To inform scam related concerns write us on FDT@creditq.in

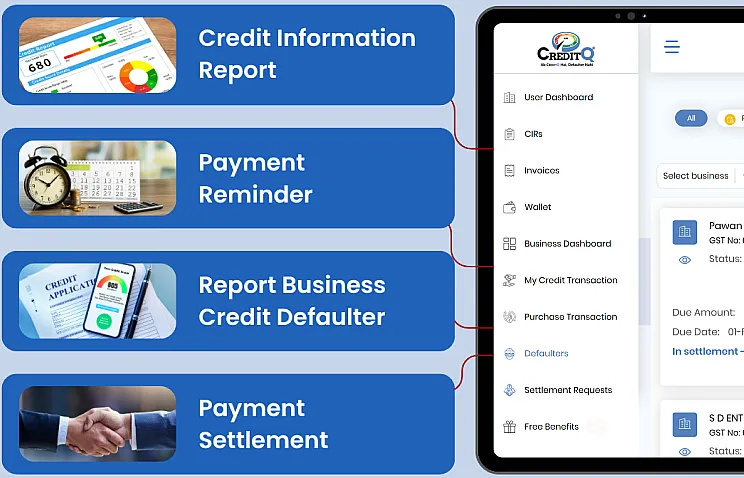

Our Services

Comprehensive solutions to protect your business and make informed credit decisions

Smart Services for Every Business Need

Report Business Defaulters

Add non-paying businesses to our database to warn others and settle your dues.

Credit Information Reports

Access comprehensive credit reports before making business decisions.

Business Credit Management

Tools and services to manage and improve your business credit profile.

Settlement Process

Structured process for resolving payment disputes efficiently.

Our Solutions

At CreditQ, we offer a suite of smart, reliable, and easy-to-use solutions

tailored to help businesses manage credit risk

B2B Solutions – Elevating Your Business with CreditQ

Unleashing the Power of B2B Solutions How CreditQ’s tailored B2B Solutions redefine the landscape

- Excellence in B2B Service

- Strategic Business Credit Solutions

- Elevating Business Credit Management

MSMEs Solutions – Empowering MSMEs with CreditQ

Unleashing the Potential: Benefits of MSME in India

- Navigating the MSME Credit Report

- MSME Registration Services – Simplifying the Process

- Leveraging MSME advantages through CreditQ

Business Credit Bureau with Auto Payment Reminder

Business Credit Bureau with Auto Payment Reminder and Follow Up for Smarter Credit Management

- CreditQ: Empowering Businesses with Smart Credit Insights

- Get Clarity with Detailed Company Credit Reports

- CreditQ: Your Partner for Credit and Settlement Management

Business Debt Solutions: Empowering Small Businesses

Business Debt Solutions or Udhaar Ko Kaise Settlement Karu: Empowering Small Businesses with CreditQ

- Understanding Debt Settlement Strategies

- Proactive Debt Resolution Techniques

- Managing Business Debts with CreditQ

Explore CreditQ in Numbers

At CreditQ, we believe in measurable progress. Our growing community of MSMEs, successful settlements, and verified business reports reflect the trust.

Highest No. of Defaulters by a Single Customer

Total Number of MSMEs Connected

%

Average Percentage of Settlements

Total amount reported defaulter

Benefits Of

CreditQ

CreditQ is designed to empower businesses with the tools they need to manage credit risk, secure payments, and build trust within the business ecosystem.

Automated reminders

It reduces the manpower and cost of the MSMEs and increase the probability to make the payment from buyer on time

Minimize Credit Defaults

Minimize the credit defaults in the

MSMEs Sector

Check CreditWorthiness

Optimize the creditworthiness of the prospective client

Digital Acknowledgement

Digital Acknowledgement of transactions which will minimize the defaults in the future

Support Indian Ecosystem

Strengthen the Indian ecosystem as CreditQ is helping in settling the default payments.

Increase Cash Flow

Help in increasing the cash

flow of business

What Our

Customers Says

Newsify is your Email newsletter Webflow template we can build anything your dream.

Latest Blogs

Stay updated with our freshest insights, tips, and stories. Explore expert

opinions, practical guides, and the latest trendsand verified business reports reflect the trust.

What is the Role of Payment Reminders in Improving Debtor Payment Settlement?

A traditional tall challenge for agencies is arranging timely payments from their debtors, and late...

What’s the Best Way to Ensure Quick Settlement from Buyers Using Automated Reminders?

In this fast-paced business environment, one has to ensure the quickest settlement from buyer to...

Frequently asked

questions

What is a credit score and what factors influence it?

A credit score is a three-digit numeric indicator of a buyer’s payment history with suppliers, showcasing their payment behavior in business relationships. This score is determined by an algorithm that evaluates various factors related to the financial activities of both individuals and companies.

How can I enhance my credit score?

Pay Bills Promptly: Ensure all bills are paid on or before their due dates.

Clear Payments on CreditQ: Settle any outstanding payments listed on the CreditQ platform.

Maintain Positive Business Relationships: Foster strong relationships with your vendors and creditors.

By following these practices, you can strengthen your credit score effectively.

What is the difference between Registration and Subscription?

Registration and subscription are two distinct processes in online services.

- Registration involves creating an account by providing personal information like name and email.

- Subscription refers to signing up for a recurring service, often requiring regular payments for access to content or services.

In short, registration is for account creation, while subscription is for ongoing access, typically involving fees.

Do I need to be GST registered to use CreditQ services?

Yes, you must be GST registered to use CreditQ services. Your business, firm, or organization needs to have a valid GST number.

How can user register on CreditQ?

CreditQ is user friendly platform to use. Only GSTN user can login in CreditQ‘s platform. For more details follow the Demo link “https://www.youtube.com/watch?v=jwyaWUUTkDg”.

Find Us on

YouTube

To Learn More About CreditQ and See All Videos, Click on The Below Button.